- “CHANGE WHAT YOU CAN I’ve learned the truth and wisdom in rich dad’s words. So much of life is out of our control. I’ve learned to focus on what I do have control over: myself. And if things must change, first I must change.”

- “If you are going to build the Empire State Building, the first thing you need to do is dig a deep hole and pour a strong foundation. If you are going to build a home in the suburbs, all you need to do is pour a six-inch slab of concrete. Most people, in their drive to get rich, are trying to build an Empire State Building on a six-inch slab.”

- Cash flow pattern of an asset:

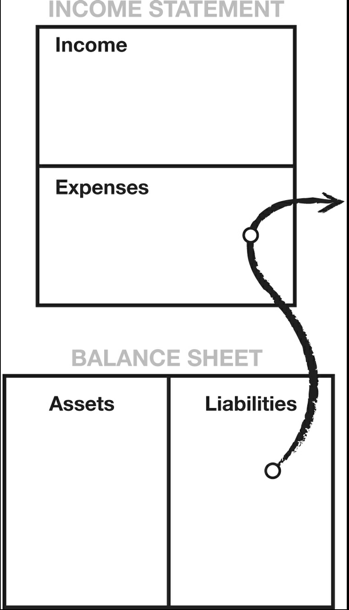

- Cashflow pattern of a liability:

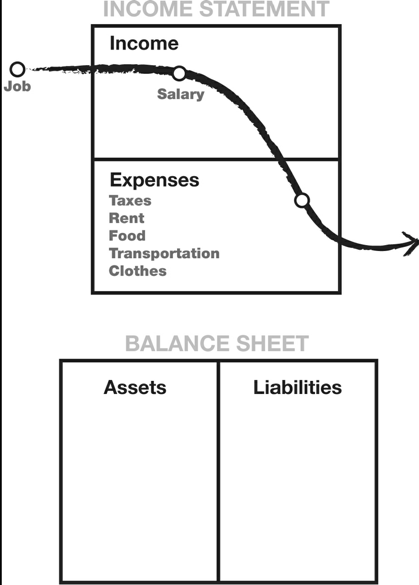

- Cashflwo of a poor person

- Cashflow of a middle-class person

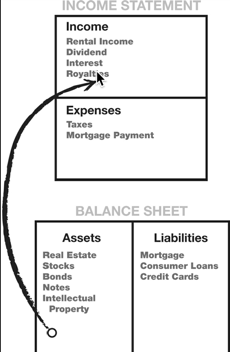

- Cashflow of a rich person

- “Before I finally learned to ride a bike, I first fell down many times. I’ve never met a golfer who has never lost a golf ball. I’ve never met people who have fallen in love who have never had their heart broken. And I’ve never met someone rich who has never lost money. So for most people, the reason they don’t win financially is because the pain of losing money is far greater than the joy of being rich.”

- “For top professional golfers, losing a ball or a tournament provides the inspiration to be better, to practice harder, to study more. That’s what makes them better. For winners, losing inspires them. For losers, losing defeats them.”

- ““Do what you feel in your heart to be right—for you’ll be criticized anyway. You’ll be damned if you do, and damned if you don’t.”

- Learn formulas that help you make money. Tranlate your learning into a formula that you can apply.

- 10 steps to be financially savvy

- Dream big, have a vision, and be reminded of that vision as you hit obstacles: eg: be financially independent by 47, travel the world and be in control of your time.

- Pay yourself first: cut a portion of income that you’re earning to go into assets, first and foremost before you pay any expenses.

- Make mistakes early and learn from them: as opposed to following the herd and buying liabilities instead of assets

- Have heros who you look up to when it comes to certain ways you do things

- Make daily choices that help you get financially independent: Create habits to help you achieve that. Expand your knowledge and key skillset to achieve that too.

- Be mindful of your social circle: associate yourslef with people you can learn from – both what to do and what not to do.

- Turn your learnings into formulas that you apply automatically

- Pay well for good advice: it can simply generate you way more money than the expense incurred through it

- For each of your investments, there must be an upside, a piece of free land, stock shares or a house.

- Use assets – not savings or income, to buy luxuries

- Teach and you shall receive: the power of giving

- Things you should know about stocks you wanna invest in, in general:

- Is it high or low for the company and for similar companies in the same industry

- The percentage of institutional ownership: the lower the better.

- Whether insiders are buying and whether the company is buying back its shares

- The records of earnings growth and whether it’s been consistent or sporadic – except asset play stocks

- Whether the company has a strong balance sheet (debt-to-equity) ratio and the cash position

- Things to check for in Slow Growing companies:

- how consistently have they paid dividends since 08?

- Dividend payout ration – helps determine how sustainable the dividend is.

- Stalwarts:

- Big companies that aren’t likely to get out of business. Most important to check for price through P/E and how high it is relative to what it was at during the last recession

- Check if the company has made acquisitions or ventured into new lines of business that could dampen growth moving forward.

- Check the company’s long-term growth rate and whether it’s kept up in the recent years.

- Cyclicals:

- Keep a close watch on inventories, and the supply-demand relationship. Watch for new entrants to the market.

- Anticipate a shrinking P/E multiple overtime as businesses recover and investors start anticipating the end of the cycle.

- Fast Growers

- Whether the successful product(s) make up a large portion of the company’s revenue

- Whether the company has been growing at around 25% YoY

- whether the company has expanded successfully to new GEOs beyond its home turf

- Whether expansion is speeding up – 5new motels this year vs 3 last year

- Turnarounds

- Do they have cash? what is the risk of them going bankrupt?

- What is the composition of their financial structure: do they issue lots of shares to raise money, diluting shareholders’ value in the process?

- Asset plays:

- What is the value of the asset(s)? what debt to subtract from it?

- “In the next chapter I’ll explain what I know about when to sell a stock, but here I want to discuss selling as it relates to portfolio management. I’m constantly rechecking stocks and rechecking stories, adding and subtracting to

my investments as things change. But I don’t go into cash—except to have enough of it around to cover anticipated redemptions. Going into cash would be getting out of the market. My idea is to stay in the market forever, and to rotate stocks depending on the fundamental situations. I think if you decide that a certain amount you’ve invested in the stock market will always be invested in the stock market, you’ll save yourself a lot of mistimed moves and general agony. Some people sell their losers and hold to their winners, others do the opposite, which is like pulling out flowers and watering the weeds. Both strategies fail because they’re tied to the current movement of the stock price as an indicator of the company’s fundamental value.As we’ve seen, the current stock price tells us absolutely nothing about the future prospects of a company, and it occasionally moves in the opposite direction of the fundamentals. A better strategy, it seems to me, is to rotate in and out of stocks depending on what has happened to the price as it relates to the story. For instance, if a stalwart has gone up 40 percent—which is all I expected to get out of it—and nothing wonderful has happened with the company to make me think there are pleasant surprises ahead, I sell the stock and replace it with another stalwart I find attractive that hasn’t gone up. In the same situation, if you didn’t want to sell all of it, you could sell some of it. By successfully rotating in and out of several stalwarts for modest gains, you can get the same result as you would with a single big winner: six 30-percent moves compounded equals a fourbagger plus, and six 25-percent moves compounded is nearly a fourbagger.

The fast growers I keep as long as the earnings are growing and the expansion is continuing, and no impediments have come up. Every few months I check the story just as if I were hearing it for the first time. If between two fast growers I find that the price of one has increased 50 percent and the story begins to sound dubious, I’ll rotate out of that one and add to my position in the second fast grower whose price has declined or stayed the same, and where the story is sounding better.

- Out of portfolio balancing, you should buy a stock when you find a company that fits the criteria mentioned above. Do not try to time the market. However, there are generally two times when stocks can go “on sale”

- between October to December: tax-loss selling may present some opportuities

- During recessions: find solid companies with fantastic earnings and growth prospects and a great balance sheet

- When to sell a stock? If you had a thesis on the stock, it becomes easier to sell when that thesis changes. Below are some guidelines to keep in mind with each category of stocks:

- Slowgrowers:

- If it goes up 50% in value

- Fundamentals deteriorate

- No new products being delveoped

- bad acquisition – paid too much money or diversified in a non financially-viable way

- Stalwarts: Do not expect a stalwart to turn into a tenbagger. And if it goes up in price, in a way that makes it P/E 20% or more higher than its comparables, this should make you consider selling

- Consider selling if the company is getting its revenue from a major product line – 25% or more, and it’s expected that it’ll be impacted by a major economic event (housing prices, oil prices)

- If insiders haven’t bought in the last year

- New products introduced in the last 2 years have mixed results and the new ones will take at least a year away before released

- Cyclicals

- Hard to tell when the cycle is about to end. Instead watch for the following:

- Issues getting supplies, driving up costs

- built-up inventory that is hard for the company to sell

- Falling commodity prices, or when the future price is lower than the spot price

- Hard to tell when the cycle is about to end. Instead watch for the following:

- Slowgrowers:

“